AS 9708 » Section 6

6.1 The reasons for international trade

6.1.1 Distinction between absolute and coparative advantage

definition

Absolute advantage — a country has absolute advantage over another country when it can produce more of a particular product given the same set of resources.

Comparative advantage — a country has comparative advantage over another in the production of a good if it can produce it at a lower opportunity cost.

A reason why a country has comparative advantage can be due to the country's resource endowments.

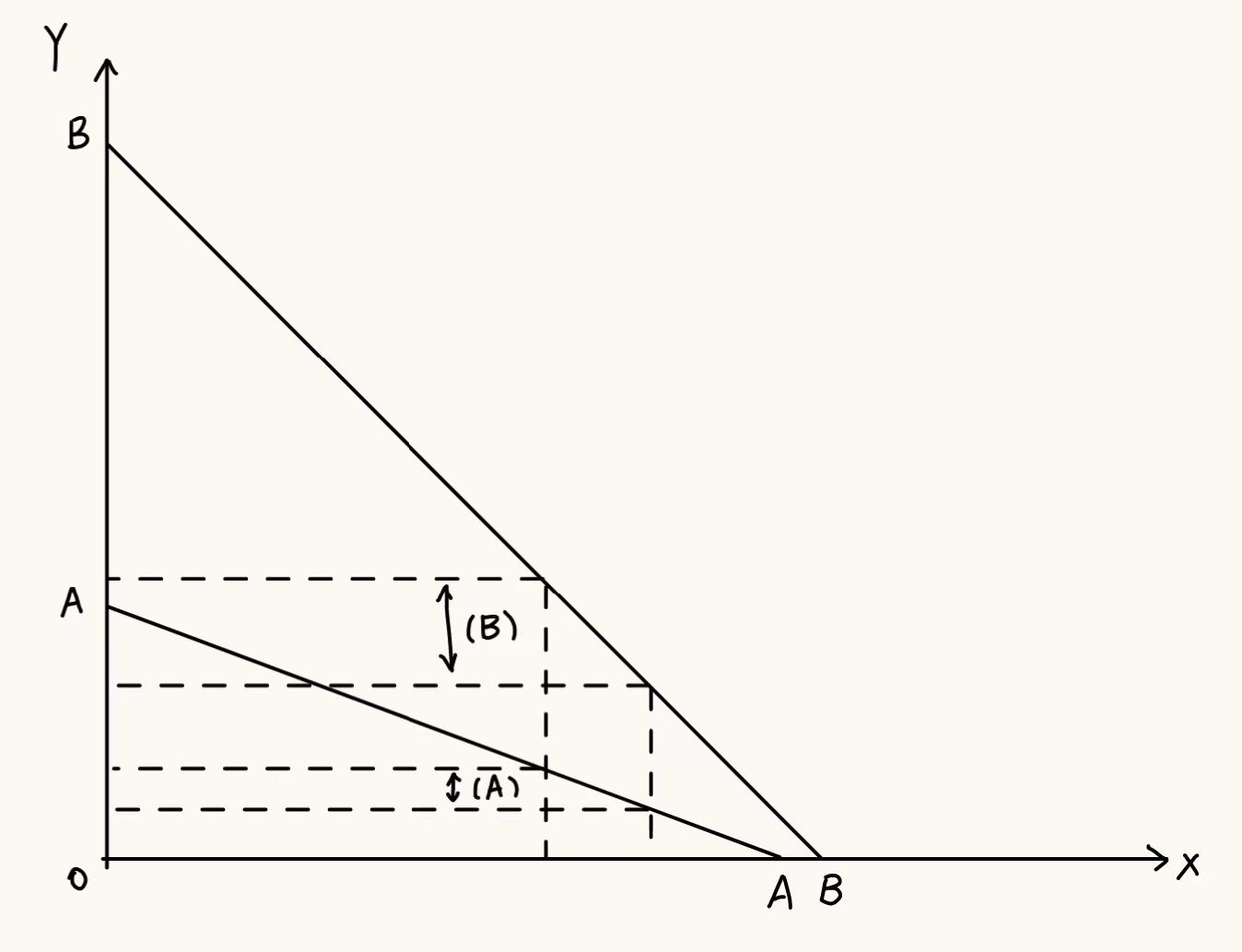

The opportunity cost ratios are reflected in the gradient of the PPC. In the following example, A has a comparative advantage in making good X.

6.1.2 benefits of specialisation and free trade (trade liberalisation), including the trading possibility curve

Benefits of specialization of countries

- Higher output and greater variety with higher living standards

- Lower costs with economies of scale

- Increase in competition for firms to be more efficient

- Spread of ideas technology and culture by exchange of information

Disadvantages of specialization of countries

- Interdependency is a threat to national security

- A decrease in demand in a country's specialized product would severely affect economy of the country

- A decrease in supply in a country's specialized product would severely affect output of the economy

definition

Trading possibility curve — the consumption possibilities available for the country following specialization and trade. (Usually outside of PPC)

6.1.3 exports, imports and the terms of trade

definition

Terms of trade (ToT) — the ratio of export prices to import prices.

Note that ToT measures relative price (level) whereas balance of trade measures value.

Causes of changes in ToT

- Price elasticity of demand

- Economic development

- Exchange rate

- Protectionist measures

- Inflation

- Population growth

- Competition

- Globalization

Advantages of a rise in ToT

- Given quantity of exports can purchase a greater quantity of imports

- Inflation may fall due to lower import price of raw materials

- Higher export prices due to greater demands leads to improvement in BoP (balance of payments)

- Increase output and employment

- Potential rise in living standards

Disadvantage of a rise in ToT

- Exports may become uncompetitive relative to imports, which may lead to unemployment and a fall in output

- Higher exports price due to tariff, leading to trade war

- Rise in exchange rate causing BoP deficit

Impact of changes in ToT depends on

- Price elasticities of demand for export and imports

- Higher ToT may worsen BoP due to a fall in exports and rise in imports over time

- The cause of the change

- Consider whether a rise in demand or rise in cost led to the change

definition

Marshall-Lerner condition — a fall in the exchange rate will lead to an improvement in the current account if the sum of the price elasticities of demand for exports and imports must be greater than 1.

warning

This is important for analyzing AD.

6.1.4 limitations of the theories of absolute and comparative advantage

Assumptions made

- No transport cost

- No trade restrictions or protectionism

- No changes in exchange rate

- Perfect competition in factor and product market

- Products are homogenous

- Factors are perfectly mobile without any diminishing return

- Constant returns to scale

- Comparative advantage may change over time

- Food security

- Two countries/goods model is oversimplified

6.2 Protectionism

6.2.1 meaning of protectionism in the context of international trade

definition

Protectionism — the protection of domestic producers from foreign competition, by interference with market forces and the relative prices of imports and exports.

6.2.2 different tools of protection and their impact

Tariffs (import duties)

definition

Tariff — a tax on imports or exports.

note

Problem with using tariffs to protect industries is that it may provoke retaliation by other countries.

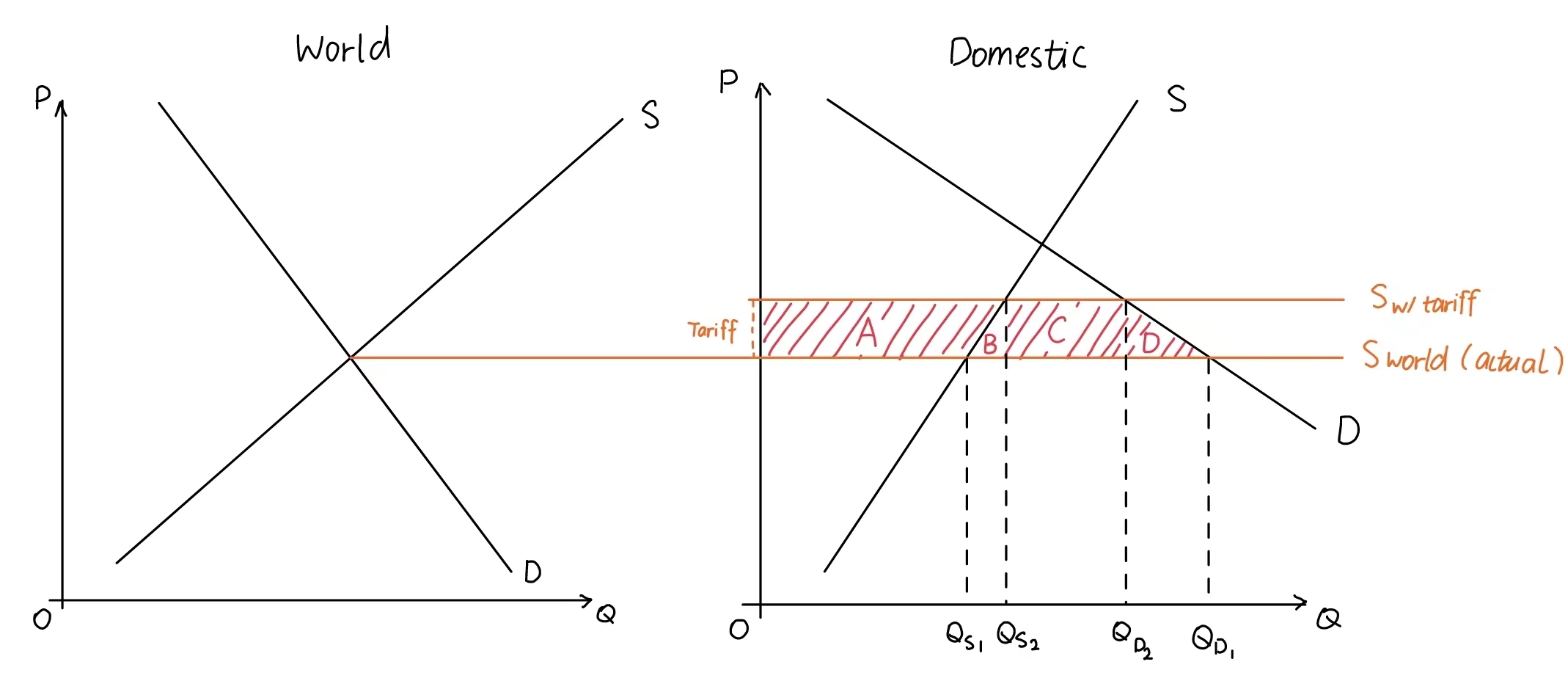

- A+B+C+D: Consumer surplus loss

- A: Producer surplus gain

- B+D: Deadweight loss

- C: Government revenue

Benefits

- Government gains tax revenue

- If PED for imports is elastic, demand will fall by a great amount

- Makes imports more expensive and less competitive, hence protecting domestic producers

Drawbacks

- Retaliation possible

- Ineffective if PED is inelastic

- Loss in consumer surplus, higher prices and lower quantity

- Deadweight loss

Import quotas

definition

Import quota — a physical limit on the quantity of imports or exports.

The beneficiary of a quota are importers that could still import into the country due to higher prices.

- A+B+C+D: Consumer surplus loss

- A: Producer surplus gain

- B+D: Deadweight loss

- C: Foreign firms revenue gain

6.2.3 arguments for and against protectionism

For protectionism

- To protect strategic industries

- To protect infant industries (sunrise industries)

- To protect declining industries (sunset industries)

- To prevent dumping

- To correct BoP deficit

- To raise government revenue

- To protect from exploited labor

- To protect from lower regulations

Against protectionism

Free trade would...

- Greater world output and consumption

- Different factor endowments brings variety and better choices to consumers

- Competition from free trade will make domestic firms more efficient to keep prices low and qualities high

- Encourage economies of scale due to more efficient use of resources

- Substantial economic growth

- Improved living standards

6.3 Current account of the balance of payments

6.3.1 components of the current account of the balance of payments

6.3.2 calculation of all of above

definition

Balance of payments — a record of a country's economic transactions with the rest of the world over a period of time (usually a year). It measures the value of economic transactions.

Credit — money coming into the country.

Debit — money going out of the country.

Current account — record of transactions of goods and services, primary and secondary income.

- BoP consists of current account, capital account and financial account.

Ideally, .

Current account consists of

- Trade in goods - visible exports and imports of goods (e.g. cars, food)

- Trade in services - invisible exports and imports of services (e.g. financial services, education)

- Balance of trade is the net trade in goods and services.

- Primary income

- Investment income (profit, dividends and interest)

- Employees' compensation (wages, salaries and other benefits)

- Secondary income (current transfers) - the transfers of money, goods and services for which there is no corresponding exchange of real goods and services.

- Government transfers (to EU, IMF, UN etc.)

- Foreign aid

- Workers' remittances (money sent from citizens to relatives abroad)

6.3.3 causes of imbalances in the current account of the balance of payments

Deficit

Short-term and self-correcting

- A growing domestic economy increase imports

- Declining economy of trading partners decrease exports

Long-term

- Structural problems

- inflation greater than trading partners

- low productivity

- overvalued currency

- increased trade barriers

Surplus

- Competitive exports e.g. German engineering products

- High productivity and low production cost e.g. Chinese manufacturing

- Undervalued exchange rate

- Protectionism

- Net investment income from FDI

- Export oriented growth

- High domestic savings rates

6.3.4 consequences of imbalances in the current account of the balance of payments for the domestic and external economy

Deficit

- Higher living standards, however...

- It can be considered as "Living beyond its means" as the country must finance the deficit by attracting investments into the country, or by borrowing.

- Lower AD due to lower (X-M), leading to higher unemployment and lower inflationary pressure, causing a fall in investment due to lower confidence in it.

- Reduction in quantity of money into the country

- This would cause a depreciation in the currency if the country has a floating currency

Surplus

- Lower living standards as goods are sold abroad

- May cause protectionist policies from other policies

- Higher (X-M) may increase AD causing higher employment and output but higher inflationary pressure. This can increase investment.

- Cause country to be exporter of capital

- If country has a floating exchange rate, it may cause currency to appreciate.

Evaluation

- Size (as a percentage of GDP)

- Duration (can be self-corrected if temporary)

- Cause

6.4 Exchange rates

6.4.1 definition of exchange rate

definition

Exchange rate — the price of one currency in terms of another currency.

6.4.2 determination of a floating exchange rate

6.4.3 distinction between depreciation and appreciation of a floating exchange rate

definition

Appreciation — the increase in price of a floating exchange rate

Depreciation — the fall in price of a floating exchange rate

6.4.4 causes of changes in a floating exchange rate

Depreciation

- CA deficit

- Higher relative inflation rate (uncompetitive domestic goods)

- Lower relative interest rate (hot money flows out)

- Low confidence causes less inward investment (FDI)

- Rise in AD (higher import)

- Speculation that exchange rate falls

Appreciation would be vice versa.

6.4.5 impact of exchange rate changes

Appreciation – benefits

- Cheaper imports

- Increasing living standards

- Lower cost-push inflation due to lower raw material costs

- Export revenue may rise if PED for exports is inelastic

- More foreign reserves allows more FDI abroad, hence higher primary income in the long run from capital outflow

Appreciation – costs

- Price of export more expensive, worsening current account if PED for exports is elastic (if M-L condition holds)

- Leads to higher unemployment

- Leads to lower output

- Capital outflow, but higher primary income in the long run.

6.5 Policies to correct imbalances in the current account of the balance of payments

6.5.2 effect of fiscal, monetary, supply-side and protectionist policies on the current account

Fiscal

- T+, G- → AD- → M-, - → CA+

- T-, G+ → AD+ → M+, + → CA-

Monetary

- IR+ → C-, S+ → AD- → M-, - → CA+

- IR- → C+, S- → AD+ → M+, + → CA-

Supply-side

- Incentives for investments and R&D → Higher comparative advantage → CA+

Protectionist

- Tariffs, quotas etc. → M- → CA+

Evaluation

- Fiscal

- Raising taxes may reduce AS and AD, and increase unemployment and economic growth

- Effective in short-term only

- Time lag

- Consumer confidence may affect the effectiveness of policy

- Size of multiplier

- Imposing tariffs may induce retaliation

- Elasticity will affect the use of tariff

- Monetary

- Raising IR will decrease AD

- Ineffective if consumer confidence is extreme

- Effective in the short term but unlikely in the long term

- Time lag

- Size of multiplier

- Exchange rate transmission mechanism may not work if demand and supply of the currency are inelastic

- A blunt instrument

- Liquidity trap

- Supply side

- Long implementation time

- Expensive

- No guarantee of success

- Deregulation may cause market failure

- Subsidies may cause retaliation

- Privatization of natural monopolies may result in higher price and lower quality